Check out our guide to running a smooth and compliant lottery with your employees for The Wallich.

You don’t need a licence from the Gambling Commission to run a ‘small society lottery’ (under £20,000 in any given year).

However, YOU MUST register with your local authority as a small society promoter.

Luckily, it’s cheap, doesn’t require a lot of red tape and keeps your lottery legal.

We’ve done the hard work of writing a compliant staff lottery sign up email.

When a staff member requests to join a staff lottery, they should be issued with a copy of the Terms and Conditions and receive an email outlining their subscription as per the below example:

“Thank you for joining <<INSERT BUSINESS NAME>> Staff Lottery.

Your first £<<FIGURE>> payment will be deducted from your salary (after tax) on DD/MM/YYYY and the last working day of each month thereafter <<USE DATES THAT ARE APPLICABLE TO YOUR PAYROLL PROCESS>>.

You will be assigned a random number and entered into the draw following each successful payment until you either cancel your lottery subscription or leave <<INSERT BUSINESS NAME>>.

The draw will take place each month following payroll processing where one number will be drawn at random winning half of the total proceeds of the lottery. The winner will be announced by email shortly after each draw.

Thanks and good luck!”

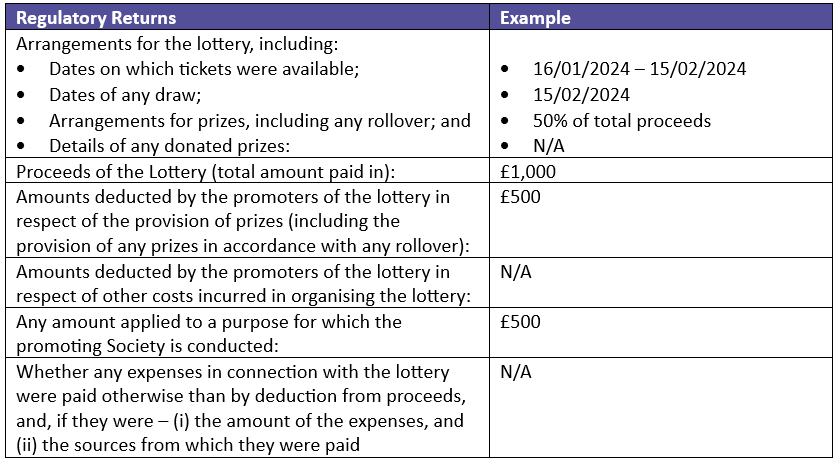

Following each draw, you will need to submit a regulatory return to your local authority (example below).

For more information about running a charity lottery at work, through your payroll team or otherwise, please contact: